- Sponsored -

How To Save Tax On Salary Legally In India: Step-By-Step Guide

If you have been worried about paying a huge sum as income tax amount, then here are few things you can consider to save tax on salary legally. Here we take you through basic information about taxes and a step-by-step guide on how you can save tax amounts from outgoing

Each employed person has to file an income tax return every year through form 16 and by doing this one pays the taxes to the central as well as state government. This form is basically a record of you paying your income taxes, which are usually deducted from your salary. There is an entire big list of legitimate reasons and ways of saving tax legally under the Income Tax Act 1961 of India. These few ways of saving tax include Mutual Funds, NPS, Insurance Premiums, Medical Insurances, Investments and a few among others. If you have been looking for ways to save your taxes, then here’s your complete guide on saving them legally and within the guidelines. Check out how you can save tax on your salary in India in a step-by-step guide.

- Sponsored -

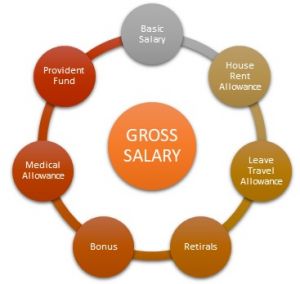

First Understand Your Salary:

1. Basic Salary

Basic salary is a decided fixed amount in your payslip. It is one of the basic portions of your salary, while there are also other allowances in it. Your PF is deducted at 12% of your basic salary. It is usually a large portion of your total salary.

2. HRA- House Rend Allowance

Each of the salaried individuals, who pay rent of their house/ apartment can claim house rent allowance or HRA to lower their tax-paying amounts. This might partially or completely exempt taxes. In order to help the taxpayers, the income tax laws have prescribed a method for computing the HRA that can be claimed as an exemption by any working individual.

Example: If a person works for an MNC company, then the company can provide them with a house rent allowance section in salary. Even if this person doesn’t live in a rented house, that person can pay the rent to his family/parents. The person can claim the allowance provided by the company just by following a few formalities. All they have to do is enter into the rental agreement with their parents/family and transfer the rent money to them. However, that person’s parents then will have to show the rent they received from the individual while filing for income tax returns.

3. Travel Allowances

Each salaried employee can get an exemption for a trip within India under LTA (Leave Travel Allowance). The government allows this exemption only for the shortest distance on any trip. The person can claim these allowances for a trip with their spouse, children, parents, or family members. Unless a person actually goes on a trip and actually spends a particular amount, they can’t claim the travel allowance. The employee needs to submit the bills to their employer in order to claim the exemptions.

4. Bonus

Bonuses are usually paid to the employees once or twice a year. Bonus is nothing but the performance incentives given to the employee, which are in some cases based on company policies. This amount is 100% taxable. Performance bonus is usually linked to an individual’s yearly appraisals on their performances and contribution towards the development of the company.

5. Employee’s contribution to PF( Provident Funds)

PF (Provident Funds) is an initiative by the Government Of India as social security. Both employees as well employers can contribute a 12 % equivalent of the employee’s basic salary every month towards the employee’s pension and PF. An interest rate for FY 2020-2021 of 8.5% gets accrued to it. There are few interesting retirement benefits that companies with over 20 employees must provide according to the EPF Act, 1952.

6. Standard Deductions

Standard deductions were re-introduced in the 2018 budget by Finance Ministry. This deduction basically replaced the conveyance allowance and medical allowances. As per the new law, the employee can claim a flat Rs.50,000 deduction from their total income. The treatment standard deduction for earlier financial years was Rs.40,000 under the old tax regimen. These deductions allow the employee to reduce the tax outgoing amount.

7. Professional Taxes:

Professional tax or tax on employment is a tax that is levied by the state government. It is similar to the income tax which is levied by the central government. The max amount of professional tax that can be levied by a state to any employee is Rs. 2,500. The amount is usually deducted by the employer and deposited to the state government.

Income That Is Chargeable To Tax Outgoing:

Every individual’s yearly incomes are not always equal to their salary. An individual can earn money from several different sources, which might also include their salary income or not in some cases. An individual’s total income, according to the Income Tax Department, could be from house property, profit/ loss from selling stocks or from interest on a savings account or on fixed deposits.

Here check out the table to understand who must pay taxes:

| 1 | Income from Salary | All those who get paid for doing their job. The received money within the contract of the company is liable for paying taxes |

| 2 | Income from house properties | Income from house property you own. Property can be self-occupied or rented house. The money that you earn from such assets |

| 3 | Income from capital gain | Income earned from the sale of a capital asset. These can be Mutual funds, House properties, Stocks, or any other assets |

| 4 | Income from business and professions | Income or losses gain while carrying on your business/ profession. Freelancers’ income can also be considered in this category. |

Methods of saving taxes from salary:

1. Invest Your Taxable Income In Different Options:

There are various options through which you can save taxable amounts. Under the Section 80C deductions of the Income Tax Act (ITA) of India, the tax-payer can claim a deduction of up to Rs. 1.5 lakh from investment in various tools listed in the below-mentioned list.

- Employee Provident Fund (EPF)

- Public Provident Fund (PPF)

- Equity Linked Saving Scheme (ELSS)

- Sukanya Samriddhi Account

- Tax Saving Fixed Deposit

- National Saving Certificate (NSC)

- Senior Citizen Saving Scheme

2. Make Charity Donations:

Several government policies encourage earning individuals to make donations, with the aim of helping the needy in society. Donations to the PM relief funds or renowned NGOs can give you 100% tax deductions under Section 80G of the ITA.

3. Home Loans:

Tax-payers who buy houses through loans can save massive amounts of tax outgoing amount. For an ongoing home loan, the individual can claim the tax deduction on their repayment of the principal amount under Section 80C. The payment of the home loan interest can also allow the individual for a deductible amount of up to Rs. 2 lakh. The only thing the individual needs to keep in mind, that the home loan has to be big.

4. Educational Loans:

An individual can be liable for a complete tax exemption when he/she takes an educational loan. There is no limit to the deductible amount. In cases of education loans, there is no exemption on the repayment of the principal amount.

5. Personal Expenses That Save Tax:

- Tuition fees for self and children

- Insurance premium of self/ spouse/ children

- Treatment of specified diseases

- Medical treatment of handicapped dependents

6. Long Term Capital Gains

If an individual sells his/her long-term asset, then they can be exempted from the Capital Gain Tax if the profit amount is re-invested in specified instruments. However, the only condition here is the individual has held this asset for over 3 years of time. The Long-term gains from equity shares and mutual funds are also tax-exempt if the individuals hold these for at least a year.

7. Get your Salary Restructured:

Different types of expenses that you make for the job are tax-deductible. An individual is liable to request their employer to restructure the given salary and accommodate allowances that are saving tax outgoing for you. Here’s a list of such allowances:

- Conveyance

- House Rent Allowance

- Driver

- Uniform

- Office Entertainment

- Medical Treatment

- Telephone

- Personality Development

8. Leave Travel Trips:

An individual can claim a tax deduction by planing leave travel trips, however, the distances should not be big ones. MNC companies provide the allowance to the employee that can allow them to deduct the tax amount. These types of claims can be made only twice in four years as well as the travel destination needs to be within India. The maximum claim one can get is of AC Tier 1 train journey or economy class air travel.

Did you find the above information helpful? Do let us know. For more such updates, stay hooked on to The Live Mirror.

Also Read: Salary Of Mukesh Ambani’s Chef Is Way More Than You Can Imagine!

- Sponsored -